Hong Kong and Singapore host first Green Finance Webinar to emphasize technical standards for improving ESG performance related to the electronics and textile industries

TÜV Rheinland invited experts and stakeholders from:

- ESG Disclosure standards (Value Reporting Foundation; Ms Katie Schmitz Eulitt, Director of Investor Relationships – SASB),

- Investors (DT Capital, Ms Jennifer Chan, Chairman and Non-Executive Director)

- ESG Ratings (Third Economy; Mr Chad Spitler, Founder & CEO),

to present the ESG ratings and technical standards in our first Green Finance Webinar on September 1 2021. This attracted interest of 97 registrants from 33 countries– spanning across various industries – from Industry Association, investors, brands, retailers and manufacturers.

Public concern for the environment and sustainable business practices have been on the rise in recent years. Going green is gradually becoming a core element of many business strategies, from retail and manufacturing to financial services. By incorporating sustainability into decision-making, organizations not only have the opportunity to have a positive impact on the environment, but also to turn a profit.

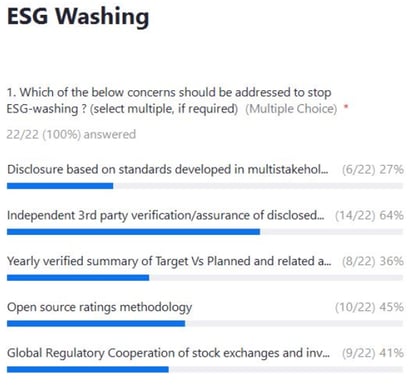

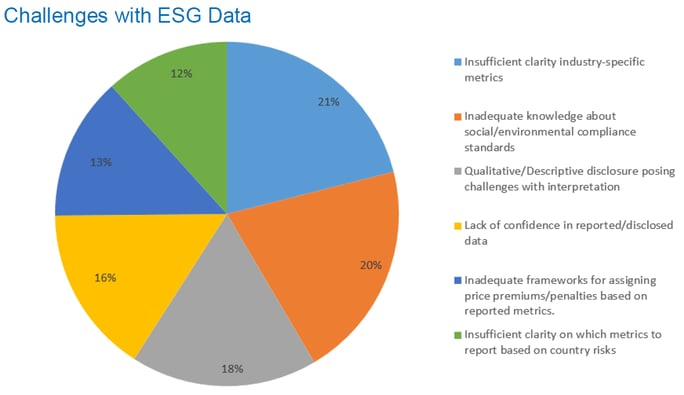

This webinar introduced the ESG rating and sustainability frameworks, providing insight and analysis to assist investors evaluate their portfolio. The European Commission published a statement this year estimating that 42 per cent of corporate websites contain claims that are “exaggerated, false or deceptive and could potentially qualify as unfair commercial practices under EU rules.” Greenwashing is a broad umbrella term used for different forms and practices of misleading communications of various organisations in relation to their performance on environmental as well as more general sustainable development-related indicators. Participants also concurred with opinion of having independent 3rd party verification of sustainability disclosures.

To more accurately establish the ESG ratings and frameworks, it is crucial to incorporate third parties to monitor the authenticity of green claims made by organisations. TUV Rheinland provides the solution, utilizing our expertise in auditing against a list of standards on environmental and social aspects. As investors are not experts on the standards, third-party validation of corporate ESG disclosed data can provide more confidence and minimise the chance of greenwashing allegations. Examples were shared to address the challenges indicated by registrants

On being asked about expectations about achievement in 2 years’ time,

- Ms Chan mentioned “ESG portfolio substantially growing, with more SMEs transforming processes towards green and better world”

- Ms Schmitz Eulitt mentioned “Less talk, more action. More convergence of standards/frameworks with regulators taking action”

- Mr Spitler mentioned “Less worried about lack of standards; with work of SASB and TUV Rheinland has progressed, so focus can be back on capital allocation at scale to solve complex problems”

- Rakesh mentioned “to have examples of technical standards harmonized and linked to ESG disclosure, along with business case for using technical standards with aim to improve ratings and returns.”

For any enquiries on the topics below, you may contact Mr. Rakesh Vazirani (Head of Sustainability, Products) at Rakesh.Vazirani@tuv.com

| No. | Focus Area | Activity / Services |

| 1 |

Policy/Strategy |

Assessment as per metrics/KPIs linked to ESG standard |

| 2 |

Product |

|

| 3 |

Process |

|

| 4 |

Supply Chain |

|