With the recent increase of focus pertaining to ESG matters amongst investors, policy makers, NGOs, and importantly the youth, there has been strong interest at assigning risk/reward values to various ESG metrics. With regards to ‘E’, focus has been on relatively simpler metric related to carbon. Nevertheless, an interdisciplinary aspect that is still being debated is how we should factor for Biodiversity as it relates to Economics.

Source: The Dasgupta Review (Options for Change, Figure 21)

Source: The Dasgupta Review (Options for Change, Figure 21)

The Dasgupta Review has demystified the complex interplay between biosphere and the economic ecosystems, while at the same time recommending options for change. This has allowed NGOs, businesses, and governments to further ponder on bankable solutions for nature. With nature, technology and human beings interacting to define our existence, it’s imperative that these 3 key capitals are protected, supported, and enhanced to help us thrive.

Path Forward: What’s Next?

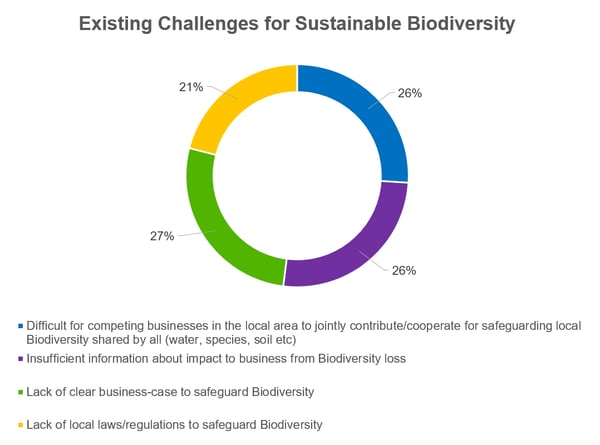

In our survey of webinar participants for "The Economics of Biodiversity: Recommendations and Financing Possibilities," we discovered challenges such as a lack of collaboration opportunities, as well as a lack of information, business cases, and regulations to effectively safeguard biodiversity. Furthermore, 85 percent of participants believe that industry-specific biodiversity metrics are urgently needed to improve the current landscape. With the global drive to achieve true sustainable biodiversity, there are huge potential for governments, businesses, and individuals to address the roadblocks collectively.

TÜV Rheinland, in collaboration with its experts and partners, currently provides assurance services that use international standards/certifications to assess the status quo and the impact of biodiversity protection measures (eg: with FSC, Alliance for Water Stewardship, Resource Efficiency programs).

|

The Economics of Biodiversity – Duration: 1 hour 32 minutes | Actual Webinar Date: 7 December 2021 With the recent surge in interest in ESG issues among investors, policymakers, NGOs, and, most importantly, the youth, there has been a strong push to assign risk/reward values to various ESG metrics. The Dasgupta Review has demystified the complex interplay between the biosphere and economic ecosystems while also recommending change. This has given NGOs, businesses, and governments more time to think about bankable solutions for nature. During this webinar, we’ll deep-dive into how financial markets impacts biodiversity and how different countries are adopting the latest frameworks/metrics to bring about real changes for Biodiversity. Featured Speakers: Dr. Hishmi Jamil Husain, Tata Steel | Mr. Peter Elwin, Planet Tracker | Mr. Hervé Barois, BIOFIN | Mr. Jan-Willem Van Bochove, The Biodiversity Consultancy | Dr. Pravir Deshmukh, Confederation of Indian Industry (CII) | Mr. Rakesh Vazirani, TÜV Rheinland |